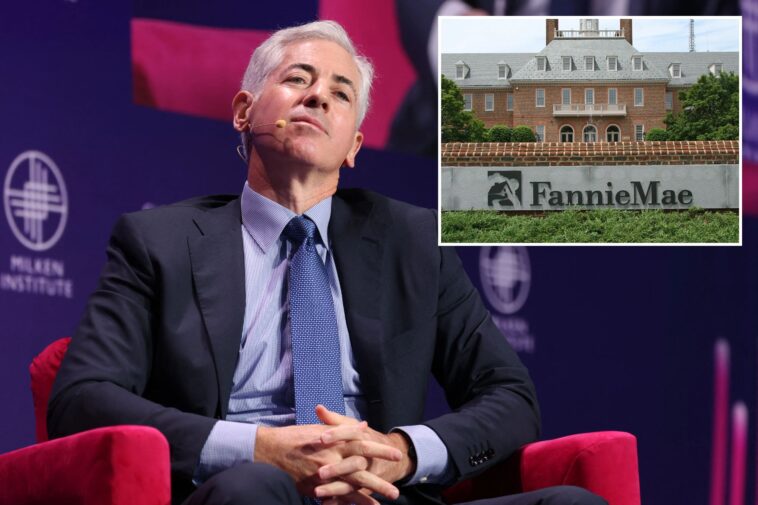

Pershing Square Capital Management founder Bill Ackman said Tuesday that proposals to sell a piece of the mortgage agencies Fannie Mae and Freddie Mac in an initial public offering is not possible in the short term.

The US government, which has been controlling the enterprises for 17 years, has been considering different structures for a potential IPO, including the creation of a single company representing both of them, but the complexity of such a deal has been a hurdle.

“The sale of a piece of these companies to the public is neither feasible nor desirable at this moment,” Ackman said during a presentation posted on X on Tuesday. Both companies are already listed in the over-the-counter market.

President Trump’s administration is “opportunistically evaluating” such an IPO, possibly as soon as the end of 2025, Federal Housing Finance Agency Director William Pulte said last month. Trump held meetings with bank CEOs to discuss this as a way to end the US conservatorship of the enterprises, which began in 2008 after they suffered heavy losses during the subprime mortgage crisis.

Ackman, whose fund owns stakes in Fannie Mae and Freddie Mac, has benefited as their share prices have risen since the government began considering a privatization.

Ackman proposed instead that these enterprises simply convert their listings currently on the over-the-counter market to the New York Stock Exchange, a process he estimated could take a few weeks.

This could result in valuations close to $400 billion for the two, he said, noting that the government’s stakes would be worth around $300 billion and could be sold off.

The billionaire also suggested other steps needed to list the companies, such as recognizing previous payments made by the agencies as repayment of the senior preferred stock issued during the crisis. Then the US Treasury would exercise warrants it got during the crisis to reach a 79.9% common stock stake. Ackman also proposed lowering the current capital requirement of 4.5% of all guarantees.

Merging Fannie Mae and Freddie Mac into a single company for a listing is out of the question, since it would require congressional approval, three sources with knowledge of the matter said in the past two weeks, asking for anonymity to discuss private talks.

Creating a holding company would be a simple way to sell stakes, but government entities are not allowed to create vehicles for this strategy, one of the sources said. An extremely complex option is to use an existing joint venture between Fannie Mae and Freddie Mac as a listing vehicle and transfer assets to it.