Senate Republicans narrowly passed the One Big Beautiful Bill Act Tuesday, sending it to the House for final approval following a 27-hour blitz of amendments.

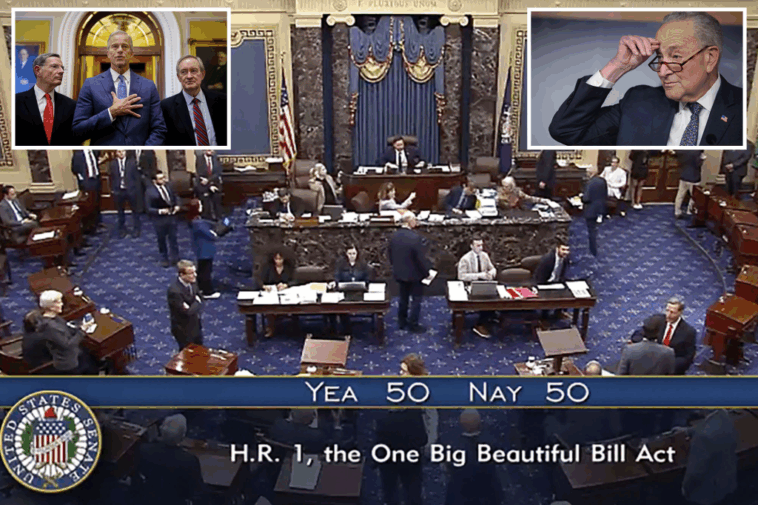

The 51-50 vote — with Vice President JD Vance breaking the deadlock — puts Republicans on track to have the bill on President Trump’s desk by the self-imposed Fourth of July deadline, if enough House lawmakers stay on board.

Republican Sens. Susan Collins of Maine, Rand Paul of Kentucky and Thom Tillis of North Carolina joined all 47 Democrats in voting “nay.”

“Today was a historic day for our country, and, we’re very excited to be a part of something that is gonna make America stronger, safer, and more prosperous,” Senate Majority Leader John Thune (R-SD) told reporters following the vote.

“This is historic in my time in Washington DC,” he added. “This is the first time we’ve done anything meaningful on entitlement reform.”

The megabill, which clocks in at nearly 900 pages, extends most of Trump’s 2017 tax cuts; reduces taxes on tips and overtime pay; and increases spending on defense, border security, and energy exploration while slashing entitlement outlays.

The legislative bundle had inched through Congress, overcoming criticism from all parts of the Republican Party.

After more than a month of deliberation, the Senate modified the House version of the legislation to extend business tax reductions, deepen cuts to Medicaid, increase the debt limit by $5 trillion, and eliminate a moratorium on state restrictions against artificial intelligence.

Sen. Lisa Murkowski (R-Alaska) emerged as the key swing vote, with GOP leadership leaning on her aggressively — and even trying to exempt Alaska from some spending cuts to woo her, but those amendments were blocked by Democrats.

“I had to look on balance, I had to look on balance,” she told reporters. “We do not have a perfect bill by any stretch of the imagination.”

“My hope is that the House is going to look at this and recognize that we’re not there yet.”

Before the vote, fiscal hawks like Ron Johnson (R-Wis.) grumbled over the One Big Beautiful Bill Act’s impact on the deficit, even threatening to derail its passage.

Eventually, leadership agreed to deepen cuts to Medicaid from the version that passed the lower chamber last month, assuaging Johnson’s concerns.

“I’m convinced they’re committed to returning to reasonable pre-pandemic spending, and I’ll be highly involved in a process to achieve and maintain it,” Johnson told “Fox & Friends” Monday morning.

Leadership was also forced to grapple with moderate Republicans who were uneasy over reforms to Medicaid and the Supplemental Nutrition Assistance Program (SNAP, aka food stamps).

“We can’t be cutting health care for working people and for poor people in order to constantly give special tax treatment to corporations and other entities,” Sen. Josh Hawley (R-Mo.) told NBC News last week.

But ultimately, Hawley backed the bill, and GOP leadership was able to keep enough moderates on board.

Another dilemma had been a 10-year moratorium against state regulation of artificial intelligence, which had been nestled in the House version.

That had seemingly been a dealbreaker for Sen. Marsha Blackburn (R-Tenn.) and drew opposition from House Republicans such as far-right Rep. Marjorie Taylor Greene (R-Ga.), who discovered that provision after it passed the lower chamber.

After negotiations and a collapsed compromise deal, the Senate decided to strip the AI regulation language completely.

On the House side, concerns from blue-state GOP lawmakers over the cap on state and local tax (SALT) deductions loomed large.

Senate Republicans modified the current $10,000 SALT cap to $40,000 for most Americans making below $500,000 per year — a concession that will be phased out after five years.

Hardliners on the House side also griped over the increased price tag of the measure, with the conservative House Freedom Caucus warning that the Senate version is “not what we agreed to.” Rep. Keith Self (R-Texas) bashed the revised bill as “fiscally criminal.”

Senators had tweaked the House version of the bill to ensure that key business tax breaks, which were set to expire after about five years, remained permanent.

Overall, the Senate’s version of the One Big Beautiful Bill Act would increase the deficit by at least $3.3 trillion over the next decade, according to the Congressional Budget Office.

That figure doesn’t account for interest on the debt, which would likely push its deficit impact closer to $3.9 trillion.

“I think the bill will add to the debt; I don’t think it’s fiscally responsible,” Paul groused after the vote.

White House officials have assured fiscal hawks that more spending cuts are on the horizon during the appropriations process this fall and that economic growth as well as tariff revenue will reduce the deficit.

Republicans have been keen on getting the bill to Trump’s desk as soon as possible, with House Speaker Mike Johnson (R-La.) arguing that delays in passing the 2017 Tax Cuts and Jobs Act cost the GOP dearly in the 2018 midterms.

Additionally, the bill has been the primary means by which Republicans plan to raise the debt ceiling, which the US was set to hit in August or September.

The Senate version approved Tuesday increased the debt ceiling by $5 trillion, up from $4 trillion in the House iteration.

Republicans passed the bill with a simple majority by relying on the Senate reconciliation process, which significantly constrained the type of legislation they could write.

If the bill undergoes any further changes in the House, both chambers will have to organize a conference committee to craft a final version of the legislation, which will have to be voted through Congress yet again.

Here is how the Senate’s megabill is different from the original House version

- Debt ceiling increased by $5 trillion rather than $4 trillion in House version

- No moratorium for state regulation of artificial intelligence

- Business tax credits — including research and development expensing and assets expensing, made permanent

- Millionaires restricted from receiving unemployment benefits

- State and local tax deduction cap raised to $40,000 through 2029, while House version made increase permanent

- Deduction for qualified tip wages capped at $25,000 and overtime pay at $12,500 for three years. The House version had no cap for income up to $160,000

- $50 billion in funding for rural hospitals in Medicaid

- Standard deduction got increased by $750 for individuals, compared to $1,000 by the House

- Child tax credit was hiked by $2,200 compared to the House’s $2,500 increase

- The 80-hour-a-month work requirement for able-bodied adults receiving Medicaid and food stamps now applies to adults with children ages 15 and up

- Removes the so-called “revenge tax” that would’ve imposed higher levies on foreign investors and companies who hail from countries deemed to have “unfair” economic systems

- Scraps language from the House version that was meant to block illegal immigrants from getting access to Medicaid.